April/May 2010

In this Issue

Building Sound Housing Policy

Historical Building Blocks for Housing Demonstration Research

Past Research Demonstrations Pave Future Roads to Policy

Surveying HUD's Surveys

In the next issue of ResearchWorks

Surveying HUD's Surveys

Housing data are important to many people,

from housing providers, to doctoral

students, to researchers from HUD's Office

of Policy Development and Research (PD&R) who

perform policy analyses and conduct surveys, studies,

and evaluations. PD&R plans to continue sponsoring

five housing surveys that together contribute to a

comprehensive view of housing in the United States.

Housing data are important to many people,

from housing providers, to doctoral

students, to researchers from HUD's Office

of Policy Development and Research (PD&R) who

perform policy analyses and conduct surveys, studies,

and evaluations. PD&R plans to continue sponsoring

five housing surveys that together contribute to a

comprehensive view of housing in the United States.

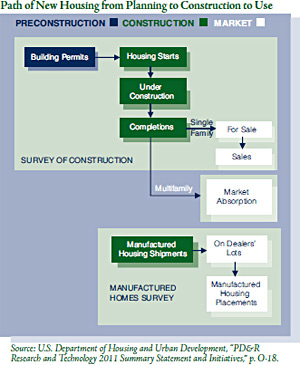

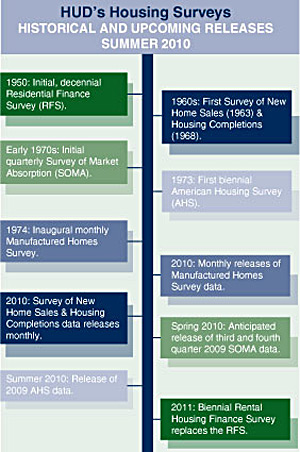

Each survey makes a unique contribution to what is understood about the nation's homes. The American Housing Survey (AHS) collects data that describe the nation's housing stock and its occupants. The Survey of New Home Sales and Housing Completions, part of the larger Survey of Construction, produces two leading national economic indicators — housing starts and building permits. The Survey of Market Absorption (SOMA) and the new Rental Housing Finance Survey illustrate the supply and demand (market absorptions) of new multifamily units and their mortgage originations, volume, and rental affordability. The Manufactured Homes Survey generates information on manufactured housing sales and inventory changes. Together, the information collected forms an integrated picture of the path that housing takes from the planning stage, through construction, to occupancy, which in turn helps shape policies that tackle America's housing challenges.

Two survey enhancements are in store: revisions to

the AHS and the addition of the Rental Housing

Finance Survey. PD&R senior economist David

Vandenbroucke offered some insights into upcoming

changes to the AHS. The largest anticipated change

is the new sample, which will take effect for the 2015

AHS. Vandenbroucke observes that "A new sample

will enable us to present our data in terms of current

metropolitan geography instead of the 1980-based

areas that we are using today.... We plan to structure the

new sample so that we will be able to produce estimates

at the Census Division level and for at least some states

instead of just at the regional level." The AHS will also

include new modules on transportation and walkability,

healthy homes, housing modifications to improve

accessibility, energy efficiency, and disaster planning.

New questions will capture the various mortgage

products now available to homebuyers. However, these

changes will not happen at the same time. "The new

supplements will begin in 2011 and 2013," according

to Vandenbroucke, with "the new sample drawn for the

2015 AHS."

Two survey enhancements are in store: revisions to

the AHS and the addition of the Rental Housing

Finance Survey. PD&R senior economist David

Vandenbroucke offered some insights into upcoming

changes to the AHS. The largest anticipated change

is the new sample, which will take effect for the 2015

AHS. Vandenbroucke observes that "A new sample

will enable us to present our data in terms of current

metropolitan geography instead of the 1980-based

areas that we are using today.... We plan to structure the

new sample so that we will be able to produce estimates

at the Census Division level and for at least some states

instead of just at the regional level." The AHS will also

include new modules on transportation and walkability,

healthy homes, housing modifications to improve

accessibility, energy efficiency, and disaster planning.

New questions will capture the various mortgage

products now available to homebuyers. However, these

changes will not happen at the same time. "The new

supplements will begin in 2011 and 2013," according

to Vandenbroucke, with "the new sample drawn for the

2015 AHS."

The other significant improvement will come with the addition of the Rental Housing Finance Survey, a replacement for the Residential Finance Survey (RFS) last conducted in 2001. The RFS has been the best available source for certain multifamily financing information, but the data are old and the survey has been criticized for some sampling issues. To address these shortcomings, HUD, Freddie Mac, Fannie Mae, and the U.S. Census Bureau are creating a scaled-back version of the survey. The Rental Housing Finance Survey will provide the only recent, nationally representative data on multifamily rental project mortgage origination volume and rental affordability — both critical for developing housing goals for government-sponsored enterprises under the Housing and Economic Recovery Act of 2008 — as well as numerous other potential uses in crafting housing policy. The sample design is composed of subsamples from two existing housing surveys: the AHS, which covers existing properties, and the SOMA, which covers newly built properties.

These surveys are among the many tools that enable PD&R to contribute to the Department's focus on evidence-based policymaking as HUD helps the nation recover from the foreclosure crisis, resolve the housing affordability gap, and support sustainable communities. The use of these tools reaches beyond HUD and extends to stakeholders in housing finance, metropolitan governance, academia, and other fields. All will benefit from the continued funding of the surveys, as well as the expanded AHS and new Rental Housing Finance Survey.