December/January 2010

In this Issue

New Approach To Serving Vulnerable Families

Foreclosure Risk Lowered With Downpayment Assistance

Stabilizing Communities With NSP Dollars

Models of Sustainable Affordable Housing

In the next issue of ResearchWorks

Foreclosure Risk Lowered With Downpayment Assistance

The recent housing crisis has made clear the

importance of ensuring that when a family

achieves homeownership, it is a sustainable

homeownership. There is always a tension when

attempting to expand homeownership, with the risk

that households will be unable to meet mortgage

obligations and remain in the homes they purchased.

This was the concern Congress had in 2006 when

it directed HUD to determine foreclosure and

delinquency rates for those who received assistance

through the American Dream Downpayment

Initiative (ADDI), a program designed to help expand

homeownership among lower-income households.

The recent housing crisis has made clear the

importance of ensuring that when a family

achieves homeownership, it is a sustainable

homeownership. There is always a tension when

attempting to expand homeownership, with the risk

that households will be unable to meet mortgage

obligations and remain in the homes they purchased.

This was the concern Congress had in 2006 when

it directed HUD to determine foreclosure and

delinquency rates for those who received assistance

through the American Dream Downpayment

Initiative (ADDI), a program designed to help expand

homeownership among lower-income households.

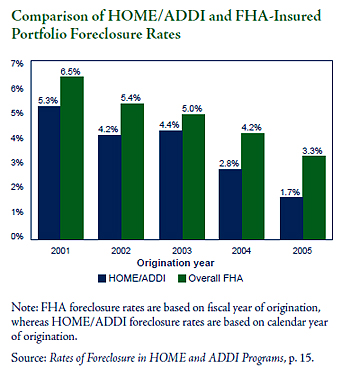

According to the resulting study, Rates of Foreclosure in HOME and ADDI Programs, such difficulties seem to be the exception, not the rule.1 This study finds that foreclosure rates among homebuyers assisted through the HOME and ADDI programs were lower when compared with the subprime market and with overall foreclosure rates for buyers with loans insured by the Federal Housing Administration (FHA). Established by the American Dream Downpayment Act of 2003, the ADDI program was funded in fiscal years 2004–2007. ADDI provided assistance with downpayments, closing costs, and rehabilitation associated with a home purchase. ADDI was not subsequently funded because HOME programs also offered the kind of assistance that made homeownership affordable and sustainable for low-income families. The funding was allocated to existing HOME programs created under Title II of the National Affordable Housing Act of 1990.2

Because both programs served lower-income

homebuyers, researchers combined data from the two

programs to obtain a larger study group. Researchers

gathered information from a representative sample of

more than 4,000 homebuyers identified by state and

local governments that administered the program.

The estimated annual foreclosure rates of HOME

and ADDI participants from 2001 through 2005

were then compared with those of the FHA-insured

mortgage portfolio as of early 2008 — a similar

population of homeowners, many of whom have

low incomes and are first-time homebuyers. The

differences were statistically significant. Between

2001 and 2005, foreclosure rates among HOME

and ADDI participants were 25 percent lower than

the rates found among all FHA-insured borrowers.

Loans originating in earlier years (2000–2002)

had higher rates of foreclosure than those in more

recent originations (2003–2005), in part because the

longer a loan is in existence, the more time it has to

experience a foreclosure.

Because both programs served lower-income

homebuyers, researchers combined data from the two

programs to obtain a larger study group. Researchers

gathered information from a representative sample of

more than 4,000 homebuyers identified by state and

local governments that administered the program.

The estimated annual foreclosure rates of HOME

and ADDI participants from 2001 through 2005

were then compared with those of the FHA-insured

mortgage portfolio as of early 2008 — a similar

population of homeowners, many of whom have

low incomes and are first-time homebuyers. The

differences were statistically significant. Between

2001 and 2005, foreclosure rates among HOME

and ADDI participants were 25 percent lower than

the rates found among all FHA-insured borrowers.

Loans originating in earlier years (2000–2002)

had higher rates of foreclosure than those in more

recent originations (2003–2005), in part because the

longer a loan is in existence, the more time it has to

experience a foreclosure.

The study explored the effects of a number of other variables on delinquency, default, and foreclosure rates. Stricter credit eligibility requirements and greater equity through homebuyer assistance and borrower cash were related to lower foreclosure rates. Adjustable-rate mortgages, high-cost loans, reliance on lenders to keep interest rates down, nonprofit seller-funded downpayment programs, and declining prices of surrounding homes, on the other hand, were all associated with higher foreclosure rates.

A factor that is strongly linked with higher foreclosure rates among HOME- and ADDI-assisted homebuyers was the use of FHA-insured mortgages. The researchers hypothesize that HOME- and ADDI-assisted homebuyers who had "poorer credit histories were more likely to rely on FHA-insured mortgages" and less likely to obtain prime mortgages. The prevalence of these riskier homeowners in the FHA portfolio resulted in these homebuyers having higher rates of foreclosure in comparison to HOME- and ADDI-assisted buyers. Nevertheless, "their foreclosure rate was still much lower than the rates experienced by buyers using seller-provided downpayment assistance and only slightly higher than the foreclosure rates of the overall FHA-insured portfolio."3

Overall, the study concludes that the HOME and ADDI programs succeeded in making sustainable homeownership possible among low-income households. However, because the study period ended before the mortgage crisis began in earnest, and because these mortgages were not significantly involved in the subprime market, an analysis of their subsequent performance is not yet available.

1 Karmen Carr, Christopher Herbert, Ken Lam, and Yusuf Makhkamov, Rates of Foreclosure in HOME and ADDI Programs, U.S. Department of Housing and Urban Development, Office of Policy Development and Research, 2008. The report can be downloaded at www.huduser.gov/publications/hsgfin/addi. html. Print copies can be ordered by calling HUD USER at 800.245.2691, option 1.

2 For information on the HOME Investment Partnerships Program, click on www.fhasecure.gov/offices/cpd/affordablehousing/ programs/home.

3 Carr, et al., p. 41.