February/March 2010

In this Issue

Returning Foreclosures to Productive Use with Land Banks

Preventing Foreclosures, One Community at a Time

Fighting Blight Pays in Philadelphia

Resilience Matters in Foreclosure Crisis

In the next issue of ResearchWorks

Resilience Matters in Foreclosure Crisis

The MacArthur Foundation's Network on Building Resilient Regions (BRR) recently sponsored a study of regional metropolitan areas and their resilience in responding to the housing crisis. The research examined two metropolitan areas with historically weak housing markets (Cleveland, Ohio and St. Louis, Missouri); two California metropolitan areas with strong housing markets (the East Bay, or Alameda/Contra Costa Counties and the "Inland Empire," or Riverside/San Bernardino Counties); and two metropolitan areas with "mixed" housing markets (Chicago and Atlanta).

Although all six areas faced substantial rises in foreclosures of single- and multifamily dwellings, their differing responses to the challenge suggest that regional resilience is a significant factor in recovery. For purposes of the study, resilience is defined as the ability to alter organizational routines; garner additional resources; and collaborate within and among the public, nonprofit, and for-profit sectors to address the foreclosure challenge.

The most resilient metropolitan areas had strong housing nonprofits and a history of collaboration across economic sectors. To act resiliently, the authors concluded, local governments must have both horizontal collaboration with local public, nonprofit, and for-profit stakeholders and vertical collaboration with state and federal players that support and empower local collaborations. We recently had an opportunity to ask the study's principal investigator, Dr. Todd Swanstrom, about the research.

Q: First, how does a regional approach help us understand the recent surge in foreclosures?

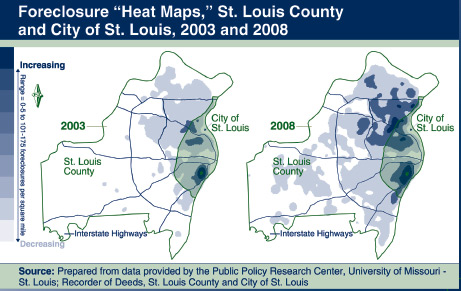

A: Foreclosures have normally been thought of as a central city or perhaps an inner-ring suburban problem. However, in this recent crisis, foreclosures have spread to the outlying suburbs and become a regional phenomenon. In our foreclosure "heat maps"-graphics showing the incidence of foreclosures overlaid on a local map-one can see the problem bleeding outward across city borders.

There is a real capacity issue-across metropolitan areas and even among various jurisdictions within them. We were more likely to find networks of robust housing nonprofits in the central city and maybe a few inner-ring suburbs. The inner city has dealt with foreclosures for decades, trying to avoid abandonment and get houses back on the market. But most outlying areas don't have that same capacity to respond-they are not used to dealing with this kind of problem.

Q: What are the elements for resilience in local housing markets?

A: First, a locale's resilience depends on its organizational ability to alter how things are done. Because many of these nonprofits are small and not very bureaucratized, they are able to shift resources when a crisis emerges-for example, toward foreclosure counseling and away from first-time homeownership programs. We found that small nonprofits have flexibility and already-established networks and are often the first to respond to a foreclosure crisis.

Second, it depends on how well the community leadership is able to find and align the resources needed through its horizontal and vertical networks. Third, resilience arises from the capacity of public, private, and nonprofit entities to collaborate effectively. It is very important to have strong housing nonprofits that are in touch with each other, governments, and other private entities, and so are better able to influence local housing policy.

Resources that can shape effective responses to a rise in foreclosures also include the attention and interest of policymakers and citizens. Our analysis of newspaper coverage indicated that media attention helps put the issue higher on the public's agenda. The foreclosure heat maps we created can help communicate and get the issue on a community's agenda. In some areas, universities have played a key role in collecting data and helping to get foreclosures on the policy agenda.

Q: What about factors beyond the metro area itself?

Q: What about factors beyond the metro area itself?

A: State laws concerning the foreclosure process also affect community resilience. In Ohio, a judicial foreclosure state, foreclosures take an average of 192 days (over 6 months) to complete. Illinois is also a judicial foreclosure state with a relatively lengthy process. Other states have nonjudicial foreclosure processes that are quicker. In Missouri, for example, foreclosures can complete in as few as 38 days, shrinking the time available for homeowners to seek help.

Other factors that affect resilience are federal incentives to encourage mortgage lenders and servicers to modify their loans, as well as federal incentives designed to help local governments address the crisis, such as the Neighborhood Stabilization Program. Relative to the number of foreclosures, however, the available federal funding is small. Localities need a strategy for targeting neighborhoods where they can make a difference-ideally, a foreclosure prevention strategy coordinated with other policy areas, like transportation and schools.

Building on this initial study in another round of research, BRR and the National League of Cities will examine how local actors can be more resilient in the face of foreclosures by continuing to study the experiences of Chicago, Atlanta, Cleveland, and St. Louis. Another hot market region, Tampa-St. Petersburg, will be compared with San Bernardino-Riverside.

1 Todd Swanstrom, Karen Chapple, and Dan Immergluck, "Regional Resilience in the Face of Foreclosures: Evidence from Six Metropolitan Areas," Berkeley Institute of Urban and Regional Development and MacArthur Foundation Research Network on Building Resilient Regions, 2009 (http://iurd.berkeley.edu/catalog/Working_Paper_Titles/Regional_Resilience_Face_Foreclosures_Evidence_Six_Metropolitan_Areas).